Global Landscape of Climate Finance 2021

The 2021 edition of Climate Policy Initiative’s Global Landscape of Climate Finance

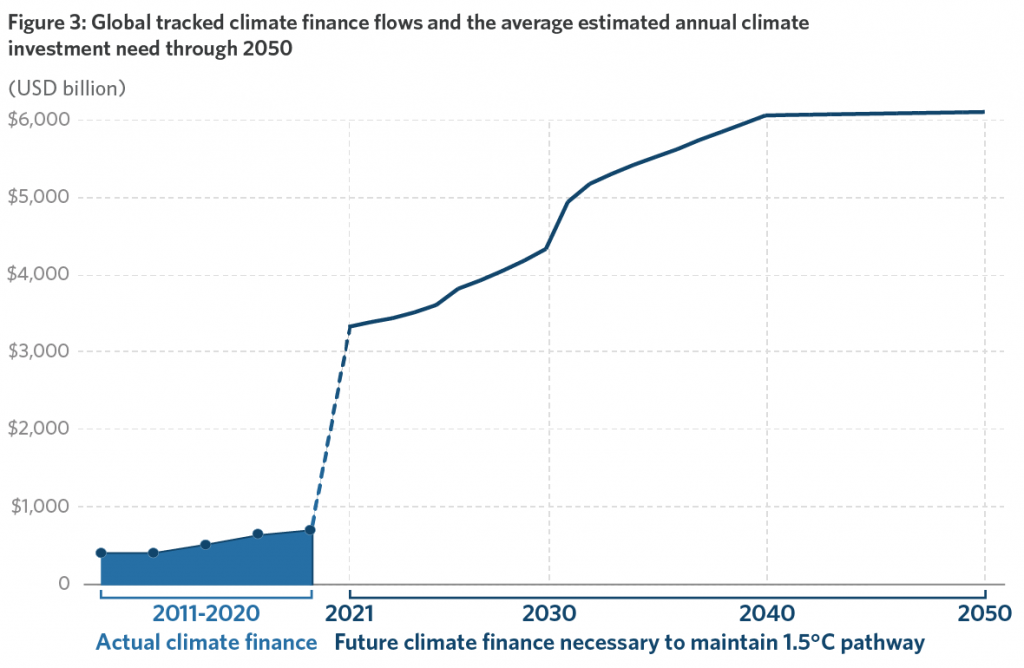

Total climate finance has steadily increased over the last decade, reaching USD 632 billion in 2019/2020, but flows have slowed in the last few years. This is a worrying trend given that COVID-19’s impact on climate finance is yet to be fully observed. The increase in annual climate finance flows between 2017/2018 and 2019/2020 was only 10% compared to previous periods, when it grew more than 24%.

An increase of at least 590% in annual climate finance is required to meet internationally agreed climate objectives by 2030 and to avoid the most dangerous impacts of climate change.

SOURCES AND INTERMEDIARIES

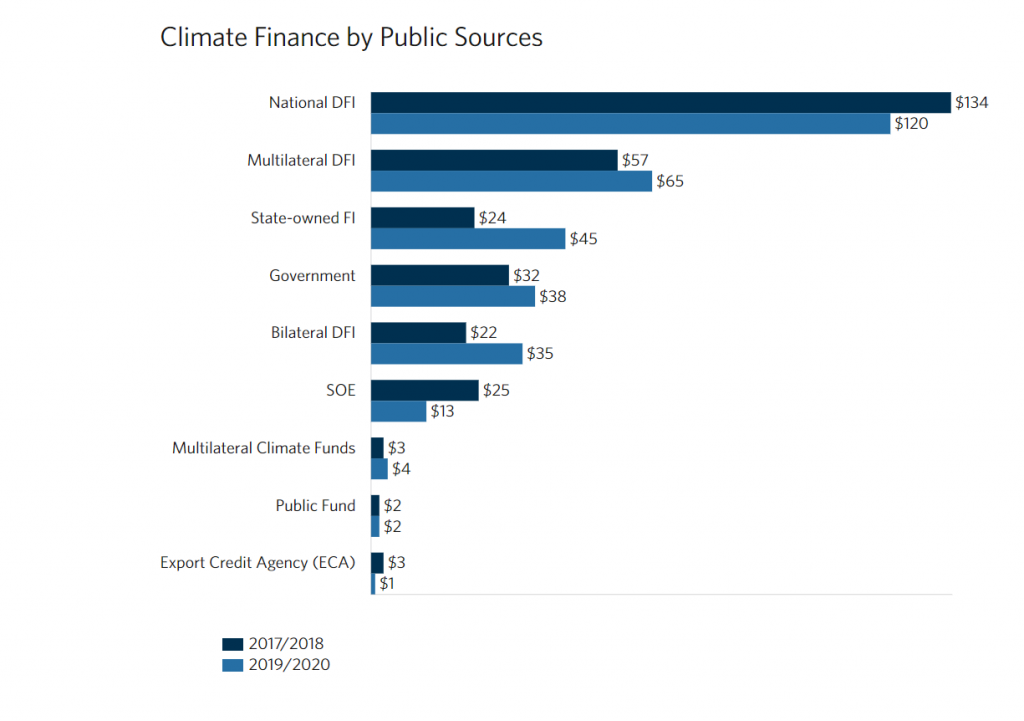

Public climate finance increased by 7% from 2017/2018, remaining largely stable at 51% (USD 321 billion) of the total.

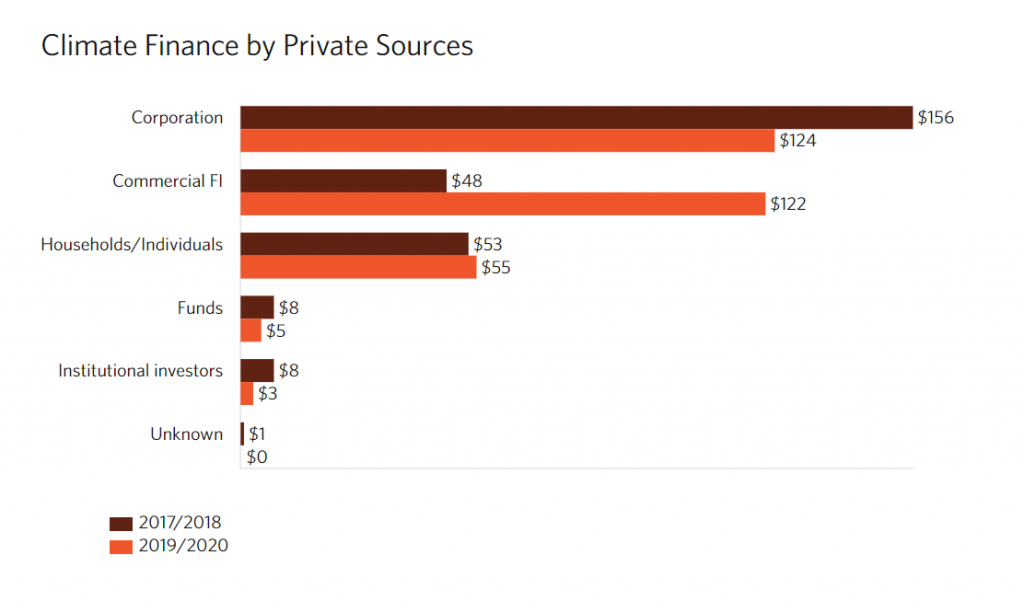

Private climate investments increased by 13% from 2017/2018 to USD 310 billion.

GEOGRAPHIES

More than 75% of 2019/2020 tracked climate investments flowed domestically. Around USD 479 billion of climate investments was raised and spent within the same country, highlighting the continued importance of strengthening national policies, public finance systems, and domestic regulatory frameworks to encourage investments and address risk. International flows registered an increase of USD 13 billion from 2017/2018 to reach USD 153 billion, primarily driven by increased public investments from DFIs.

Three-quarters of global climate investments were concentrated in East Asia & Pacific, Western Europe, and North America, while the remaining regions received less than a quarter. East Asia & Pacific accounted for almost half (USD 292 billion) of 2019/2020 tracked global climate investments, up by USD 43 billion compared to 2017/18. An estimated 81% of the investments in the East Asia & Pacific region were concentrated in China.

RECOMMENDATIONS

Climate finance flows are nowhere near estimated needs, conservatively estimated at USD 4.5 – 5 trillion annually. To achieve the transition to sustainable, net-zero emissions, and resilient world this decade, climate investment must increase drastically. High-emissions investments continue to flow in key sectors, curbing the impact of new finance towards climate mitigation and adaptation. Climate investment should count in the trillions, whereas fossil fuel investments, which exceed USD 850 billion annually, should dramatically decrease in this decade. Climate finance commitments also need to translate into action in the real economy, requiring all public and private actors to align their investments with Paris goals and net-zero, sustainable pathways.

Filling the investment gap for adaptation is critical to achieving the goals of the Paris Agreement. Finance to adaptation, from both public and private actors, must be scaled by orders of magnitude to respond to current and oncoming climate risks. Information on investment in adaptation must also improve. The current limitations of adaptation finance tracking, especially of private sector finance, hinders tracking of progress towards a critical aspect of the Glasgow Climate Pact: increasing adaptation support for emerging and developing economies, especially those that are the most vulnerable to the impacts of climate change.

Wider and better reporting on the interlinkages between climate finance and other sustainable development goals (SDGs). Climate finance offers synergies for attaining other SDGs simultaneously, however, currently, the data is scarce. More granular reporting can help assess the landscape of synergistic climate finance, directing attention to the distribution of benefits across different beneficiaries (women, youth, rural and indigenous populations) as well as the efficacy of flows.

To read the entire report, click here