Survival of the Richest: The India Story

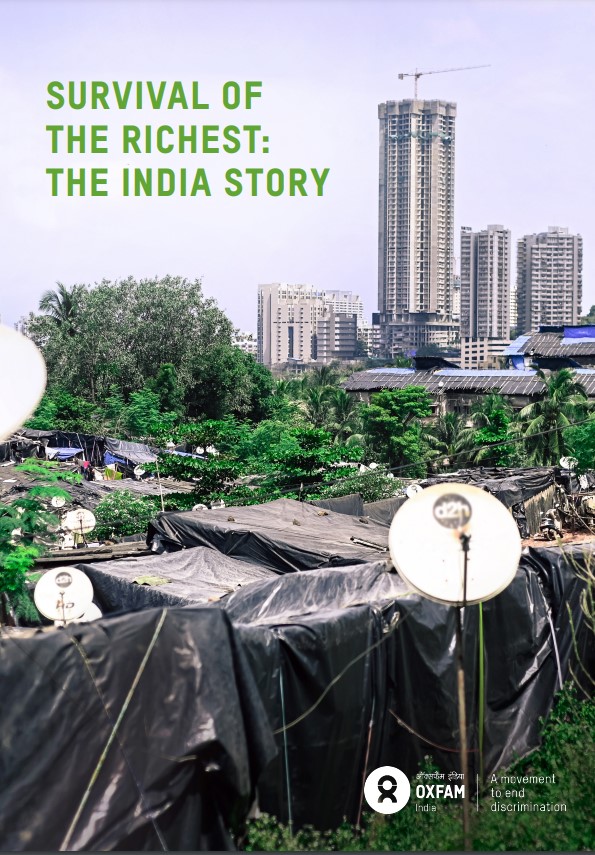

The report highlights the contrasting realities of the rich and poor.

The gap between the rich and poor in India is widening at a rapid rate. COVID-19 proved to be another catalyst in exacerbating the gap. The country still has the world’s highest number of poor at 228.9 million. On the other hand, the number of billionaires has increased from 102 in 2020 to 166 billionaires in 2022. The top 30 percent of the richest hold 90 percent of the total wealth. The combined wealth of India’s 100 richest has touched INR 54.12 lakh crore.

To highlight these stark contrasting realities of rich and poor, Oxfam has released a report titled ‘Survival of the Richest: The India Story’. This article will analyze the key findings of the report.

Poor are Suffering

World Inequality report stated that India is among the most unequal countries in the world. Factors like caste, gender, and social class play a huge role in determining the income status of people in India. The Reserve Bank of India has also reported a rise in personal debt in 2022. The following data sets put this in perspective.

- Wealth Inequality has hampered the Indians from accessing basic needs like a healthy consumable diet. This caused the deaths of nearly 1.7 million people in a year owing to poor diet.

- Majority of the Indian workforce is in the informal sector with no social protection, fixed tenure of job, and a regular salary. Daily wage workers are particularly vulnerable where the NCRB data reported that 115 daily wage workers died by suicide every day in 2021.

- Indian household spends the highest on health with high out-of-pocket expenditure. This is estimated to be INR 2,87,573 crore as against the government expenditure of INR 2,42,219 crore on the health sector.

Rich are getting Richer

In stark contrast, there is an extreme concentration of wealth among the rich. Increase in private wealth has decreased public wealth where government spending on public assets is not yielding returns. The increase in GDP has mostly yielded gains for the rich leaving the poor with consequences of inequalities. Following are the datasets to ponder upon.

- The wealth of the top richest stands at 27.52 lakh crore which is a 32.8 percent rise from 2021.

- The top two industries that have the most billionaires are the Healthcare sector (32) and the Manufacturing sector (31). The pandemic has added a fair share of wealth by creating 7 new billionaires in the healthcare and pharma industry in 2021.

- Top 10 percent own more than 80 percent of the concentrated wealth.

Inflation and Inequality

Greater tax slabs and inflation has hampered the savings share of the bottom section of households. The burden of tax has shifted from the corporates towards individual taxpayers. This is even despite the corporates seeing a gain in profit by 70 percent in 2021-22 and the households seeing a decline of their income by 84 percent in the same period. Food inflation is higher than 7 percent in 2022. This inflation cuts a large share of the savings of the bottom section as they spend 53 percent of their earnings on food as against 12 percent by the top section.

Taxing the Rich

The report ‘Survival of the Richest: The India Story’ recommends taxing the rich to bridge the inequalities. 80 percent of revenue earned by the government comes from taxes. There has been a decline of 8 percent in corporate tax which makes the government rely more on indirect taxes. Indirect taxes are paid by every citizen that is levied on every commodity.

- Bottom 50 percent of the population at an all-India level pays 6 times more on indirect tax as a percent of their income than the top 10 percent.

- 64.3 percent of the total tax from food and non-food items comes from the bottom 50 percent.

In stating these inequalities, the report has recommended taxing the rich. Following are the public good commodities that can benefit if tax is levied on the rich and directed to social policies.

- 3 percent of wealth tax on the total wealth of billionaires can fund the National Health Mission – the largest healthcare scheme in India.

- Taxing India’s billionaires at 2 percent can support the nutrition of malnourished in the country for 3 years.

- Taxing the wealthiest 10 billionaires at 1 percent can fund the Samagra Shiksha scheme for 1.3 years.

The other ways to bridge inequality recommended by the report are

- Easing the tax burden on the poor and marginalized

- Improving access to public services like health and education

- Strengthening safety nets and bargaining power of labor

You can read the full report here!