2022 Global Gender Wealth Equity

The report elaborates on the significant gender wealth gaps between men and women at retirement.

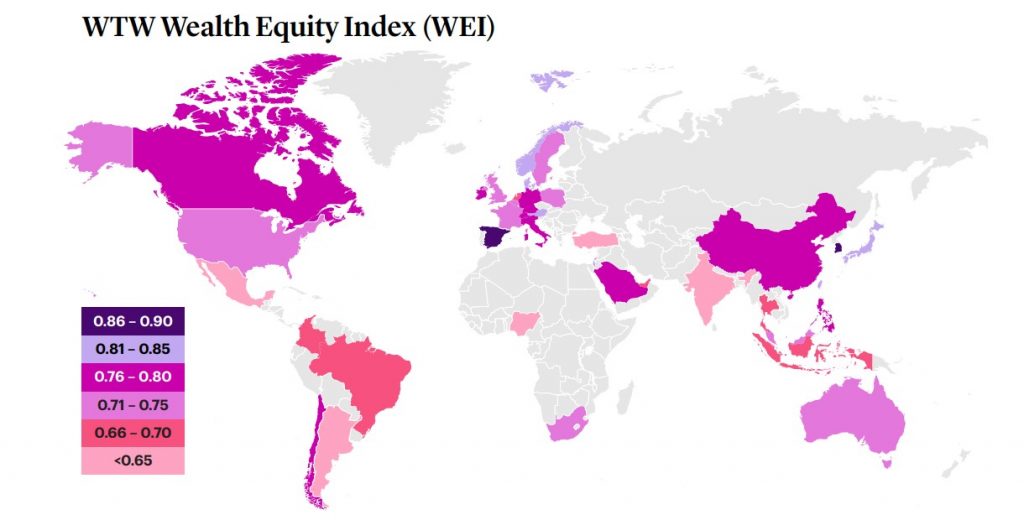

Willis Towers Watson in collaboration with World Economic Forum has released the ‘2022 Global Gender Wealth Equity’ Report. The report elaborates on the significant gender wealth gaps between men and women at retirement. The index analyzed 33 countries across the globe.

What is Wealth Equity Index?

The Wealth Equity Index is developed by the WTW to understand the extent of the gender wealth gap and disparity in male and female wealth accumulated over their career life cycle.

To conclude,

Wealth Equity Index = Female accumulated wealth/ Male accumulated wealth

The WEI is measured between 0 and 1, where

- 1 indicates no accumulation of wealth

- Indices closer to 0 indicates a high difference in wealth accumulation

Reasons for Inequity

Following are some of the reasons that the report mentions that are key determinants in unequal wealth accumulation

- Gender Pay Gaps and Delayed Career Trajectories

- Career Absences due to Maternity Leave and Additional Responsibilities like Childcare and Eldercare.

- Gaps in Financial Literacy

- Lower Financial Awareness and Risk Tolerance

Key Findings of the Report

- Women accumulate only 74% of the wealth than men upon retirement.

- Women in senior positions face the largest gaps in accumulated wealth due to gender pay gaps and delayed career paths.

- Caregiving responsibilities lower women’s workforce participation and time spent employed. No sufficient leave provision for childcare widens the wealth gap.

- Women are disproportionately affected by COVID-19 because they have left the workforce or reduced their working hours as they are primary caregivers at home.

Wealth Inequity in India

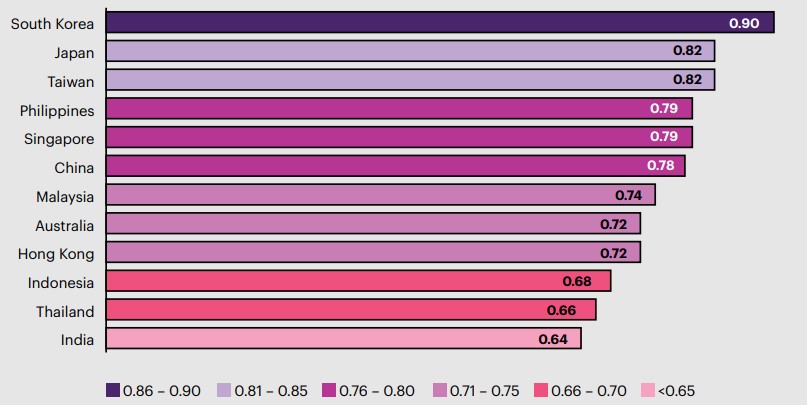

Among its Asia peers, India ranks lower at 0.64 in the equity index. The highest ranked are South Korea, Japan, and Taiwan.

Following are the observations by the report about inequity in wealth accumulation by women in India.

- Women in India in professional and technical roles, as well as leadership positions, face more gender pay gap

- Merely 3% of Indian women are in senior leadership positions.

- Women assume childcare responsibility from a young age which puts them on a lower pedestal at the start of their careers than their male counterparts.

- Men make the financial decisions in the household which limits the wealth accumulated by women. This factor also tends to have low financial literacy among women.

Recommendation to bridge Wealth Inequity

The report gives action areas for employers to implement in their organization to make the workforce truly equitable, inclusive, and diverse.

- Intentionally enabling careers for women by eliminating bias in giving promotions or salary hikes.

- Reducing the gender pay gap by reevaluating HR policies by understanding initial offers made for women while recruiting them.

- Encouraging financial literacy by conducting workshops on investments and improving their financial risk tolerance.

- Taking career breaks by women into account while framing retirement policies.

- Considering caregiving support while designing wealth programs

- Flexibility in the workplace and remote working opportunities to balance their caregiving responsibilities

You can read the full report here!