Nonprofit Financial Planning for COVID-19

Here’s how we should plan for the financial health of our organisations for the next three to nine months.

by MAHAMAYA NAVLAKHA, SATYAM VYAS

There is an increasing agreement across industries, sectors, and businesses that the world that emerges post COVID-19 will be very different from the world as it was, not too long ago. While we are all grappling with the immediate effects of the pandemic, we need to be prepared for the economic repercussions that we will feel in 2021.

As most nonprofit founders and CEOs are executing strategic plans to keep their teams safe, it is also important to simultaneously develop plans to keep our organisations alive, so that when the dust begins to settle, and the world begins its path to recovery, people will have jobs to return to, and the programmes we run will continue to create impact on the ground.

We can expect funding to potentially take a downturn, either due to a reduction in the overall funds available, or as a result of funds being redirected towards more imminent causes—COVID-19 relief and rehabilitation work, livelihoods, and healthcare. With this in mind, many nonprofit leaders in India and globally may have to make difficult choices to stay afloat. That’s why it is imperative that we examine the financial health of our organisations for the next three to nine months and begin to plan an appropriate response.

We need to be prepared for the economic repercussions that we will feel in 2021.

We know that the suggestions made in this article might not universally apply for all nonprofits—each leadership team knows their organisation best, and is therefore best equipped to make relevant assumptions. While none of us know how the situation will unfold in the next month or longer, we are hoping that by providing a guide, we can help leadership teams think through the different scenarios that might arise as a result of it.

Mapping out Future Scenarios

An effective way to prepare organisations financially is to run a scenario planning exercise, and prepare for the worst- and best-case scenarios. In our experience, a relatively simple and useful way to do this is by defining three stages—best-case scenario (Stage 1), average-case scenario (Stage 2), and worst-case scenario (Stage 3)—and creating plans and financial models for each.

It is important to plan actions in phases, like any other programme implementation work a nonprofit would take up.

Here are steps that can be applied for effective scenario planning:

1. Create your financial model

In an Excel document, create four sheets:

- The first for grant statements, along with timelines (mention the current status and any expected tranches)

- The second for the expenditure sheet

- The third to list employees and their monthly salaries

- The fourth for variables or assumptions (for example, donors might decide to convert restricted grants into unrestricted grants, might not disburse tranches as per the contract, delay payments, and so on)

2. Decide your three scenarios based on fixed and variable costs

The assumptions below have been made based on our understanding of how organisations might be affected. Please modify them based on your needs.

- Best case scenario: Lockdown continues till end April 2020—Five weeks of impact on the programme; some people are impacted by COVID-19 either directly or through family members; partial quarantines. New donors’ responses slowed by 50 percent; productivity of employees reduced by 25 percent (working at home/distracted by news), fixed costs stay fixed.

- Average case scenario: Lockdown continues till end May 2020—Nine weeks of impact on the programme; more people are impacted by COVID-19 either directly or through the family members; partial or complete quarantines. New donors respond to some funding requests; productivity of employees reduced by 35 percent (working at home/sick/have sick parents/news/reduction in salaries), fixed costs stay fixed.

- Worst case scenario: Lockdown continues till end June 2020—Thirteen weeks of impact on the programme; more people are impacted by COVID-19 either directly or through the family members; complete quarantines. Donors stop responding to any new funding requests; productivity of employees reduced by 50-60 percent (working at home/sick/have sick parents/news/furloughs/layoffs), some of the fixed costs stay fixed.

It is important to keep in mind that the scenarios need to be defined for each organisation’s context, programmes, and financial situation, and will vary from organisation to organisation.

A case study: Leadership for Equity

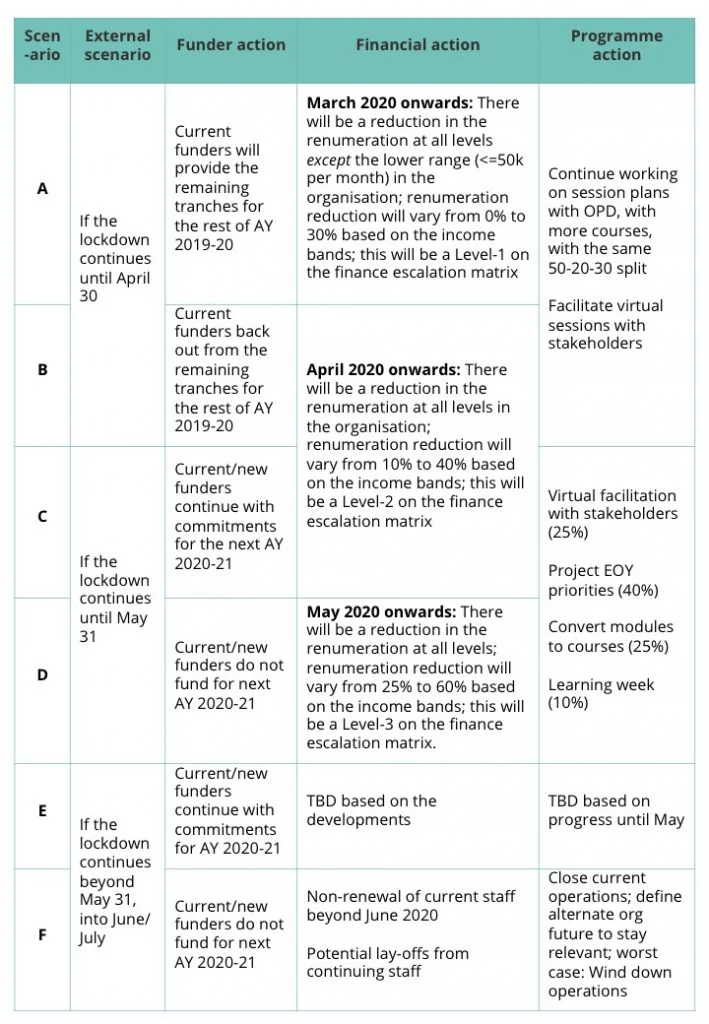

Madhukar Banuri (CEO and Founder, Leadership for Equity), and his team developed a template for six case scenarios, similar to those above. This section presents his template, keeping some key aspects in mind:

- The data and figures shared in the template are to illustrate and explain the format only. The template is not based on real data and is not specific to any organisation.

- The scenarios are for explanatory purposes; organisations would have to work out scenarios based on their specific contexts.

- The template defines ‘external scenarios’ as those being outside the organisation’s control, such as the imposition of a lockdown, the date till which it will be imposed, and other governmental restrictions.

Here, financial action is driven by the idea that in any situation, steps must be taken to give the organisation a runway of an additional three months. For example, if an organisation can continue without reducing financial expenses for six months, it would help to plan how this runway can be increased to nine months. In the above case, escalation levels based on three expected external scenarios have been defined, with the assumption that the strength of the organisation stays the same.

It is essential for nonprofit leaders to think about their ‘guiding principles’ when undertaking such planning. For Madhukar, these were:

- Juggle motivation, anxiety, and short term priorities

We are all struggling to stay motivated. We’re trying to manage anxiety about the situation, be productive, and manage uncertainty around government orders and travel restrictions, all the while keeping our project priorities going. It is here that the art of juggling—not balancing—these multiple thoughts is critical. - Weigh the pros and cons of re-purposing your organisations

Leaders need to think long and hard about their core mission and vision, and whether or not they feel the need to re-purpose their organisations. This is a difficult, but important question at a time when everyone is moved to do something specific about the situation, and many organisations are choosing to re-purpose their budgets and human resources. There is no right answer, but it’s an answer that each organisation needs to define for itself. - Remember, the future is hard to predict

In such unprecedented situations, predicting the future is difficult. It is best to critically understand and plan for potential situations (as per the scenarios you choose), affected resources, and subsequent milestones. - Connect with and learn from networks

Individuals, organisations, and nations, are all going through tough times. Connecting with those who are in similar positions allows for opportunities to collaborate on solutions, or learn from those who have a better understanding of the situation. In order to make informed decisions, it is essential to keep learning from sector veterans and other organisations. - Prevent the organisation from going underwater

Laying off team members and shutting down the organisation are two scenarios that need to be avoided at any cost. Therefore, financial decisions should be made to give the organisation as much financial runway as possible, in the hope that at some point things start to turn around.

Three things to consider when financial planning for your organisation

- Reduce fixed costs: Take a hard look at fixed costs (such as office rent) to see what can be cut or reduced over a period of time.

- Rethink programme cost: Rethink the design of programme delivery—can scope or certain aspects of a programme change?

- Re-examine people costs: While appraisals could continue as usual, the financial aspect linked to appraisals could be deferred by a quarter. One idea to explore could be salary reduction within the leadership team, and absorbing the hit before entry- and mid-level employees face cuts. In a worst-case scenario, if employees have to be laid-off or furloughed, keep in mind that team members at highest risk—those that are employed at a lower salary—should be impacted least by these policies.

The authors would like to thank Madhukar Banuri for sharing his experiences, knowledge, and processes with them.